In this week's Spring Statement, the Chancellor announced his new Tax Plan to reduce and reform taxes across the United Kingdom – tackling the cost of living, incentivising private sector-led growth and delivering on the biggest cut to personal taxes in over a quarter of a century.

The IMF said the UK had the fastest growing economy in the G7 last year – the announcement from the Chancellor, Rishi Sunak, seeks to remain responsible on public spending and public finances to protect and increase this growth whilst helping families with the cost of living.

Richard Fuller MP said:

The Chancellor had to strike a difficult balance this week: providing extra support as prices rise following the Russian invasion of Ukraine whilst holding back public spending as global interest rates rise. In my view - and I am generally a quite small “c” conservative on financial matters - I think the chancellor struck a good balance.

Many of us remember the 70s and early 80s when inflation never fell below 8%, or the early 90s when double digit mortgage rates were not unknown. We know that times will be tougher for everyone, certainly for the year ahead, and we know there are (and should be) limits on what government can do. Focusing help on those with low incomes, particularly low fixed incomes, should be the priority.

With the cost to taxpayers of servicing the government’s debts doubling in one year, we need a new era of public service efficiencies to ensure a quality of service at overall affordable costs. There are many examples of such improvements over the past decade but we must keep up the pace of change.

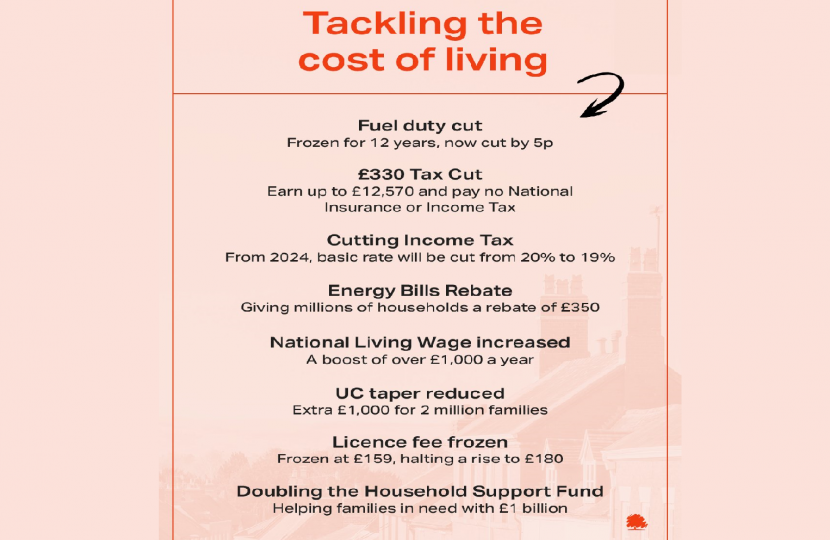

The government is delivering the biggest net cut to personal taxes in over a quarter of a century and that is only possible because of the disciplined approach to public spending. This new Tax Plan, which includes cutting fuel duty, cutting the basic rate of Income Tax and cutting National Insurance for 30 million working people, will help families with the cost of living, create the conditions for private sector-led growth, and share the proceeds of growth fairly.

Measures set out by the Chancellor include:

Slashing fuel duty by 5p for twelve months, delivering a £5 billion tax cut for drivers. Together with the fuel duty freeze, this will save car drivers £100, van drivers £200, and HGV drivers £1,500 this year.

Rising the National Insurance personal threshold from £9,500 to £12,570 from July, delivering the largest increase in a starting personal tax threshold in British history. This is equivalent to a £6 billion tax cut for nearly 30 million workers and worth over £330 a year starting in July, across the entire United Kingdom. This is the largest single personal tax cut in a decade.

Helping people keep more of what they earn by cutting the basic rate of income tax to 19 pence in 2024, delivering a tax cut worth £5 billion for over 30 million workers, pensioners and savers – only the second income tax cut in two decades and the first income tax cut for 16 years. This will be worth around £175 for a typical taxpayer.

Raising the employment allowance to £5,000, delivering a £1,000 tax cut for small businesses. The Employment Allowance cuts employers’ national insurance tax bills by increasing the employment allowance even further to £5,000 from April – that’s a new £1,000 tax cut for half a million small businesses.

Doubling the existing Household Support Fund to £1 billion, delivering an additional £500 million to the Household Support Fund. This helps the most vulnerable families with the cost of living. The fund is distributed through local authorities in England, who have discretion over exactly how the funding is used. This is expected to benefit 3 to 4 million vulnerable households.